Three Rising Method Candlestick Pattern: Candlestick patterns serve as a crucial technical tool for traders seeking to comprehend price movements. The patterns that materialise on candlestick charts during a specific time period provide insights into potential trend reversals, continuations, or market indecision.

In this article, we will explore the Three Rising Method candlestick pattern in depth, examining its significance, characteristics, and strategies using chart examples.

Three Rising Method Candlestick Pattern – Meaning

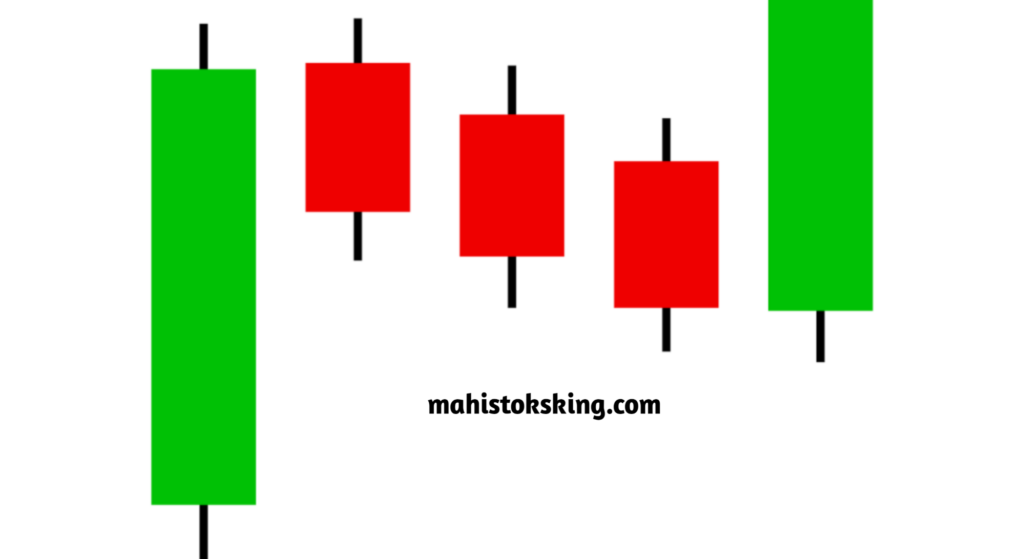

The Rising Three Method candlestick pattern is a bullish continuation pattern that appears during an uptrend. It consists of five candles, a large green candle, followed by three small red candles, and then a final large green candle that closes above the first candle.

This pattern indicates that the current uptrend may experience a minor retracement but will likely continue in the direction of the uptrend. It is a reliable signal for traders to hold on their long positions or enter new long positions, anticipating a continuation of the bullish trend.

Three Rising Method Candlestick Pattern – Formation

- The first candle is a large green candle, which is a part of the uptrend

- The next three consecutive candles are red candles that close within the low and high of the first green candle

- The final candle is a large green candle that closes significantly above the high of the first green candle.

- This pattern suggests that the buyers have regained control after the slight pullback in the market.

Three Rising Method Candlestick Pattern – Psychology

The Rising Three Methods candlestick pattern reflects the psychology of the market during an uptrend. The pattern begins with a strong bullish candle, indicating the bulls are firmly in control.

However, the appearance of the next three smaller bearish candles suggests weakness in the uptrend, as the bears attempt to take over temporarily. This creates a period of consolidation in the market. Despite the bears’ efforts, they are unable to push the price below the low of the first bullish candle, signalling the bulls’ strength. The pattern with a final large bullish candle that closes above the high of the first candle confirms the continuation of the uptrend.

Three Rising Method Candlestick Pattern – Trading Ideas

Before the appearance of this pattern, traders should ensure that the previous trend must be an uptrend. Once this pattern is formed, the following are the trade details-

- Entry– After the formation of the pattern, traders can take a long position at or just above the close price of the final candle of the pattern.

- Profit Target- Traders can exit the trade when the price of the security reaches near the immediate resistance zone or based on the risk-reward ratio.

- Stop loss- The stop-loss can be placed below the low price or the close of the first candle.

Three Rising Method Candlestick Pattern – Example

In the above chart of Happiest Minds Technologies Ltd, we can observe the formation of the Three Rising Method candlestick pattern.

At the time of the formation of this pattern, a trader could have taken a long position when the price of the stock started trading above Rs. 868.90 and the stop loss was at Rs. 864.40.

Three Rising Method Candlestick Pattern – Key Characteristics

- Formation: The pattern is a five-candlestick continuation pattern that forms in the middle of an uptrend.

- Price Action: Formation of three continuous small red candles after the first candle formation.

- Volume: The fifth green candle in the pattern should be accompanied by strong volumes for a better chance of confirmation.

- Continuation Signal: The three-rising method pattern suggests that the bullish trend is likely to continue, as it demonstrates that buyers are still in control.

- Confirmation: The fifth candlestick acts as a confirmation of the continuation of the uptrend.

Next post :- All 4 IPOs launched today subscribed fully. Check GMP and other details